Global Markets React as Nations Struggle with US Trade War Strategy

Global Trade Tensions: How Countries Are Responding to the U.S. Tariffs and Market Instability

In recent times, the global economy has been rocked by a growing trade war triggered by the United States. Countries around the world are trying to figure out how to react to these sudden changes, while financial markets swing wildly in response to every new development.

Let’s break down what’s happening, why it matters, and how different nations are reacting — all in easy-to-understand language.

What Is the US Trade War Response All About?

The trade war began when the United States, under the leadership of President Donald Trump, decided to place higher taxes — known as tariffs — on imported goods from other countries. These tariffs affect products from countries like China, Canada, Mexico, and the European Union.

The U.S. government says the goal is to protect American businesses and workers. They believe that other countries have been taking advantage of trade deals and that raising tariffs will bring back jobs and make American industries stronger.

However, this move has sparked a series of back-and-forth responses — with other countries imposing their own tariffs in return.

China’s Strong Response to US Tariffs

Tariffs are extra costs added to imported goods. For example, if the U.S. places a 25% tariff on steel from Canada, that steel becomes more expensive in the American market. The idea is to encourage people to buy U.S.-made steel instead.

But tariffs can also raise prices for consumers, hurt companies that rely on imports, and slow down international trade.

The Global Reaction

When the U.S. raised tariffs, many countries responded with their own:

- China slapped tariffs on U.S. agricultural and manufactured products.

- Canada imposed new tariffs on American steel, aluminum, and other goods.

- Mexico introduced taxes on U.S. farm goods, steel, and more.

- The European Union responded with tariffs on American motorcycles, jeans, and even peanut butter.

These retaliatory measures have led to confusion and tension among global trading partners.

Markets Are Feeling the Heat

Financial markets around the world have been on a roller coaster. Stock prices are rising and falling dramatically with each new trade-related announcement.

In the U.S., major stock indexes like the S&P 500 and the Dow Jones Industrial Average have seen major losses. Investors are worried that the trade war could hurt company profits and slow down the global economy.

Asian markets have also seen sharp swings. In Japan, the Nikkei 225 index dropped significantly, then bounced back briefly. In Southeast Asia, markets in countries like Indonesia and Thailand have faced serious losses.

In Europe, Germany’s stock market fell as well, showing that the impact is truly global.

What This Means for Everyday People

The trade war isn’t just about governments and big businesses — it affects everyday people too.

- Higher prices: Tariffs can make everyday items more expensive, from food to electronics.

- Job uncertainty: Industries that rely on global supply chains — like car manufacturing — may cut jobs if costs rise too high.

- Investment risks: People with retirement savings or investments in the stock market may see their portfolio values drop.

Why Countries Are Struggling to Respond

Governments are in a tough spot. On one hand, they want to protect their local industries and workers. On the other hand, fighting fire with fire — by raising their own tariffs — could make things worse.

Some countries are calling for negotiations and trade deals that are fair to everyone. Others are preparing for long-term trade fights.

India’s Position

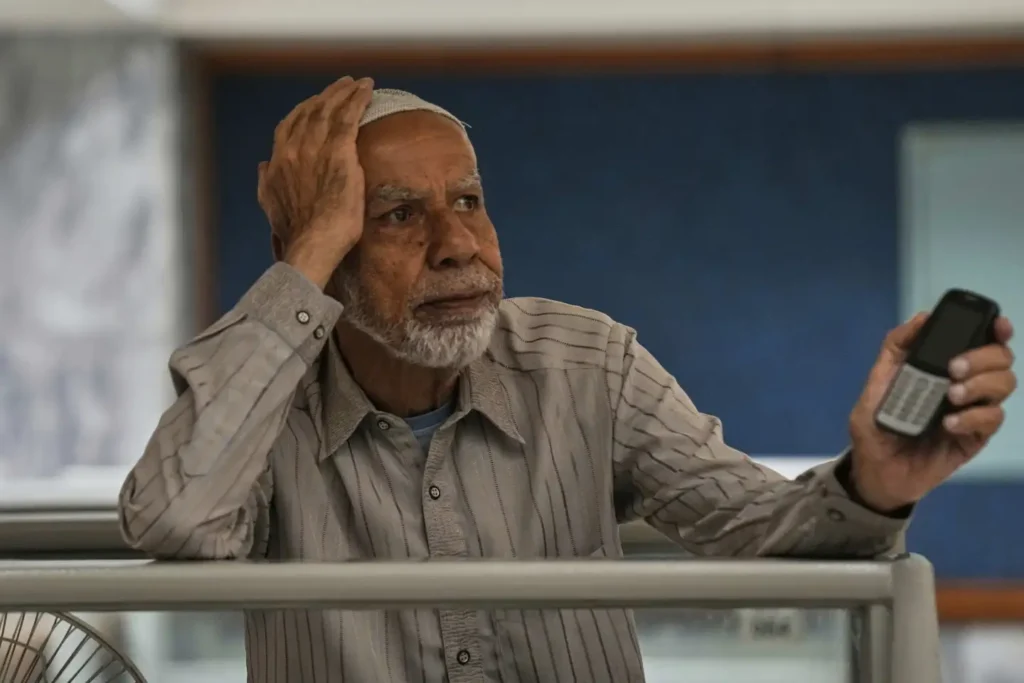

India has so far taken a cautious approach. Although it hasn’t been hit directly like China or the EU, India is still watching the situation closely.

Indian exports could be affected, and rising global prices might hurt local businesses. The government is looking at ways to strengthen trade with other partners and avoid too much reliance on any one country.

Experts Warn of a Bigger Problem

Many economists say that this trade war could lead to a global slowdown. When countries put up barriers to trade, the flow of goods and money slows down. That means fewer jobs, lower profits, and slower growth.

They say that in a connected world, cooperation is better than conflict. If each country focuses only on protecting its own interests, the whole system could collapse.

Call for Diplomacy and Cooperation

World leaders, including the United Nations Secretary-General, have urged all sides to come to the table and talk. They believe that through discussion and compromise, it’s possible to reach agreements that benefit everyone.

Some businesses and tech leaders have also spoken out. They worry that ongoing trade battles will hurt innovation, slow down progress, and divide the global economy.

Can This Trade War Be Stopped?

There’s still hope that things can improve. Trade deals and talks have worked in the past, and many countries are still open to discussion.

However, reaching a solution will take time, trust, and cooperation. Everyone — from world leaders to small business owners — will need to play a part in finding common ground.

Final Thoughts

The trade war started by the U.S. has put the global economy in a tough spot. Countries are struggling to figure out how to protect their own interests without making things worse.

Financial markets are shaky, businesses are uncertain, and consumers could face higher costs. But with open communication and fair negotiation, it’s still possible to avoid a full-blown economic crisis.

As the situation unfolds, it’s important to stay informed and understand how these global events can affect our daily lives. For more insight on global trade dynamics, you can explore resources like World Trade Organization (WTO) which promotes international trade rules and fair practices.